How Late Payments Impact Your Credit Report

Let’s consider Sarah, who missed her credit card payment by just 35 days while moving between apartments. Like many consumers, she didn’t realize this single oversight would slash her credit score by 83 points – enough to push her from “good” to “fair” credit status overnight.

We’ve seen how late payments can trigger a cascade of financial complications, from higher interest rates to denied apartment applications. While the impact of tardy payments might seem overwhelming, understanding exactly how they affect your credit score is the first step toward protecting your financial future.

Key Takeaways

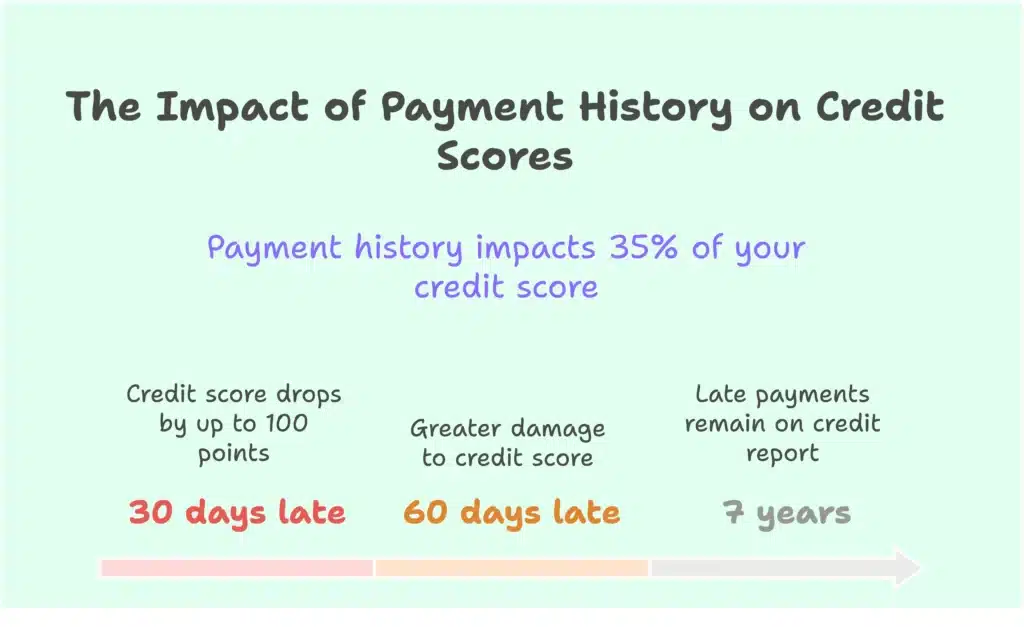

- Late payments reported after 30 days can drop credit scores by up to 100 points, with longer delays causing greater damage.

- Payment history accounts for 35% of your FICO score, making late payments one of the most damaging credit events.

- Late payments remain on credit reports for seven years, affecting loan approvals, interest rates, and potential employment opportunities.

- Multiple late payments signal higher risk to lenders, potentially leading to account closures and decreased credit limits.

- Recovery from late payments requires consistent on-time payments for several months and may involve negotiating with creditors.

Understanding Credit Report Payment Status

When you check your credit report, you’ll notice specific codes that indicate whether your accounts are current or behind on payments. Your payment history shows different categories of lateness, from 30 days to 150+ days past due, which directly impact your credit.

While accounts 1-29 days late typically aren’t reported to the credit bureaus yet, once you hit the 30-day mark, that late payment becomes official on your record.

These late payments remain on your credit reports for seven years, regardless of whether you’ve since closed the account. Since creditors update the credit bureaus monthly, you mightn’t see a late payment reflected for 1-2 months.

That’s why regular monitoring of credit reports is essential – it helps you catch and address any negative entries before they cause long-term damage.

At New Leaf Financial, we can help you understand exactly what’s showing up on your credit reports and create a clear plan to address any negative entries. Schedule a free consultation today to start the journey to rebuilding your credit.

When Late Payments Get Reported

Most creditors won’t report your late payments to credit bureaus until you’re at least 30 days past due, though this timeline can vary by lender.

After you miss your payment due date, you’ll typically have a brief window to catch up before it affects your credit history.

- Late payments usually appear on credit reports within 1-2 months after missing the payment due date.

- Payments that are 1-29 days past due often don’t get reported late and may still show as current.

- Federal student loans mightn’t be reported late until 90 days past due.

Once a payment is reported late, it’ll stay on your credit report for seven years from the original delinquency date.

While some creditors might wait up to 60 days to report, it’s essential to make payments before hitting that 30-day mark to protect your credit.

Severity of Payment Delays

The severity of late payments on your credit score follows a clear pattern – the longer you wait to pay, the worse the damage becomes.

When you’re 30 days late, creditors report the missed payment to credit reporting agencies, potentially dropping your credit scores by up to 100 points, especially if you’ve maintained excellent credit.

At 60 days, the impact intensifies, signaling greater financial hardship to future lenders.

Once you hit 90 days late, you’ll likely face notably higher interest rates and fees. Even worse, your account may be sent to collections, causing long-lasting damage to your credit.

We can’t stress enough how multiple late payments compound these negative effects, making it vital to catch up on any missed payments immediately to minimize the harm to your credit health.

Credit Score Damage Assessment

Understanding how late payments affect your credit score requires looking at the hard numbers. A single late payment can slash up to 100 points from your credit score, with payment history weighing heavily at 35% of your total score calculation.

Credit score damage assessment shows the impact escalates markedly after payments are 30 days late, becoming more severe at 60 and 90 days.

- Your credit reports will show late payments for seven years, though the impact diminishes with consistent on-time payments.

- Payment delinquencies reaching 90 days often lead to charge-offs and collection accounts.

- A good credit score can take a bigger hit than lower scores when payments are missed.

The severity of credit score damage from late payments makes it essential to prioritize timely payments and understand their lasting consequences on your financial health.

Recovery After Missed Payments

While recovering from missed payments can feel challenging, you’ll find several effective strategies to rebuild your credit standing. We recommend bringing your account current within 30 days to prevent reporting to credit bureaus. Contact your creditors promptly to discuss fee forgiveness or alternative payment arrangements.

Need help negotiating with creditors? Our team at New Leaf can guide you through these conversations and help explore all available options for getting back on track.

| Recovery Steps | Timeline | Impact |

|---|---|---|

| Immediate Action | 0-30 days | Prevent reporting |

| Consistent Payments | 1-6 months | Rebuild trust |

| Long-term Monitoring | 6+ months | Track progress |

Preventing Future Payment Issues

Taking proactive steps to prevent late payments can protect your credit score and help you avoid costly fees.

We recommend implementing several strategies to maintain consistent, timely payments. Setting up automatic payments for at least the minimum amount due guarantees you won’t miss payment due dates, while calendar alerts serve as helpful reminders for managing bills.

- Work with creditors to adjust payment due dates to align with your income schedule

- Make multiple payments throughout the month to maintain lower credit utilization

- Contact creditors immediately if you’re experiencing financial hardships to explore repayment plans

Negotiating With Credit Card Companies

When late payments happen, proactive communication with your credit card company can make a significant difference in protecting your credit score. We’ll help you understand how to negotiate effectively with credit card companies after a missed payment.

| Strategy | Key Benefits |

|---|---|

| Hardship Programs | Negotiate adjusted payment terms and lower interest rates |

| Goodwill Letters | Request removal of late payment marks with documented history |

| Quick Response | Higher chance of fee waivers for first-time missed payments |

| Build Rapport | Customer service representatives more likely to grant requests |

Remember that your payment history and account history play essential roles in these negotiations. By documenting any extenuating circumstances and maintaining open communication with your creditors, you’ll increase your chances of successful negotiations. Late payments affect your credit, but taking immediate action can help minimize the impact.

Payment History Impact Timeline

Since payment history carries the heaviest weight in credit scoring, understanding how late payments affect your credit timeline is essential. Your payment history accounts for 35% of your credit score, making it vital to maintain financial responsibility.

When you miss a payment by 30 days, your credit score can drop by up to 100 points, with even steeper declines for longer delays.

- Late payments stay on credit reports for seven years, potentially affecting future credit applications.

- The negative effect becomes more severe as time passes, with 60-day late payments causing greater damage.

- You can minimize the impact through consistent on-time payments, which demonstrate improved financial habits.

Remember that building a positive payment history takes time, but it’s the most effective way to recover from previous late payments.

Credit Bureau Reporting Schedules

Credit bureaus operate on specific timelines when recording late payments in your credit history.

We’ve found that most creditors report late payments after 30 days of non-payment, though federal student loans may wait until 90 days have passed. The good news is that if you’re just a few days behind, payments that are 1-29 days late typically won’t show up as delinquent on your credit reports, and your account status may still appear current.

When a payment remains unpaid, you can expect it to show up on your credit report within one to two months after the due date.

Credit bureaus receive updates from creditors monthly, using specific codes that indicate exactly how late the payment is, ranging from 30 days to over 180 days past due.

Building Better Payment Habits

Three fundamental strategies can help you develop reliable payment habits and protect your credit score.

First, we recommend setting up automatic payments to guarantee you never miss a minimum payment.

Second, establishing flexible payment due dates with your creditor can align perfectly with your income schedule.

Third, implementing reminders through calendar alerts keeps you on track with all payment deadlines.

- Contact your creditor to adjust due dates and explore payment options that work best for your financial situation

- Set up credit monitoring to stay informed about changes to your credit reports

- Make multiple payments throughout the month to maintain lower credit utilization

Conclusion

Just like a tiny snowball rolling downhill can trigger an avalanche, a single late payment can set off a chain reaction of credit damage. We’ve seen how these delays can slice up to 100 points from your score and linger for years. Let’s commit to setting up automatic payments, calendar reminders, and better budgeting habits to keep our credit scores healthy and our financial futures secure.

Let's Build Your Path to Better Credit

Get expert analysis of your credit situation and discover the steps to achieve your financial goals.

Book a ConsultationRealted Posts

What Credit Score Is Needed to Buy a Car

Just as climbing Mount Everest requires different levels of preparation for various routes, securing a car loan demands different credit scores depending on your chosen path. You’ll find

What Credit Score Do First-Time Homebuyers Need to Buy a House?

If you’re one of the millions of Americans planning to buy your first home in 2025, you may be wondering what credit score a first-time home buyer needs