About Us

At New Leaf Financial Services, we believe everyone deserves a second chance at building strong credit. Through personalized credit restoration strategies and expert guidance, we help families across America achieve your financial goals.

Trusted by Families,

Nationwide

$200k+

Customers Debt Resolved

50+

Average Point Improvement

48hr

Hours Action Plan Delivery

95%

Client Satisfaction Rate

Our Story

We started New Leaf Financial Services to empower families to improve their financial well-being and gain control over their credit. Our goal is to provide guidance and resources that you build a strong financial foundation, enabling you to achieve your financial goals with confidence.

Our Vision

Our vision is to create a future where every family has access to fair credit opportunities and financial stability, regardless of your past challenges.

Our Mission

We're committed to empowering families through personalized credit restoration strategies, educational resources, and ongoing support to help you achieve your financial goals.

We are guided

by the following principles

Trust

We maintain the highest standards of honesty and transparency in our credit restoration process, ensuring you understand every step of your journey.

Empowerment

Your success drives everything we do. We provide the tools, knowledge, and support needed to take control of your financial future.

Excellence

We continuously refine our credit restoration strategies and services, ensuring you receive the most effective solutions available.

Dedication

We understand the impact of credit on families' lives, and we're committed to helping your build a stronger financial foundation.

Our Process

Your Journey to Better Credit Starts Here

Get a Free Consultation

1

Review your credit situation, discuss your goals, and receive a customized action plan.

Get Our Expert Analysis

2

Our specialists perform a comprehensive credit report review and develop your personalized strategy.

Get a Strategic Action

3

Implementation of targeted credit improvement tactics with close progress monitoring.

Receive Ongoing Support

4

Regular updates and strategy adjustments ensure you achieve your credit goals.

Take Control of Your Credit Future Today

Your journey to better credit starts with a conversation. Schedule your free consultation to get professional guidance and a custom action plan.

Book a consultationCredit Restoration Resources

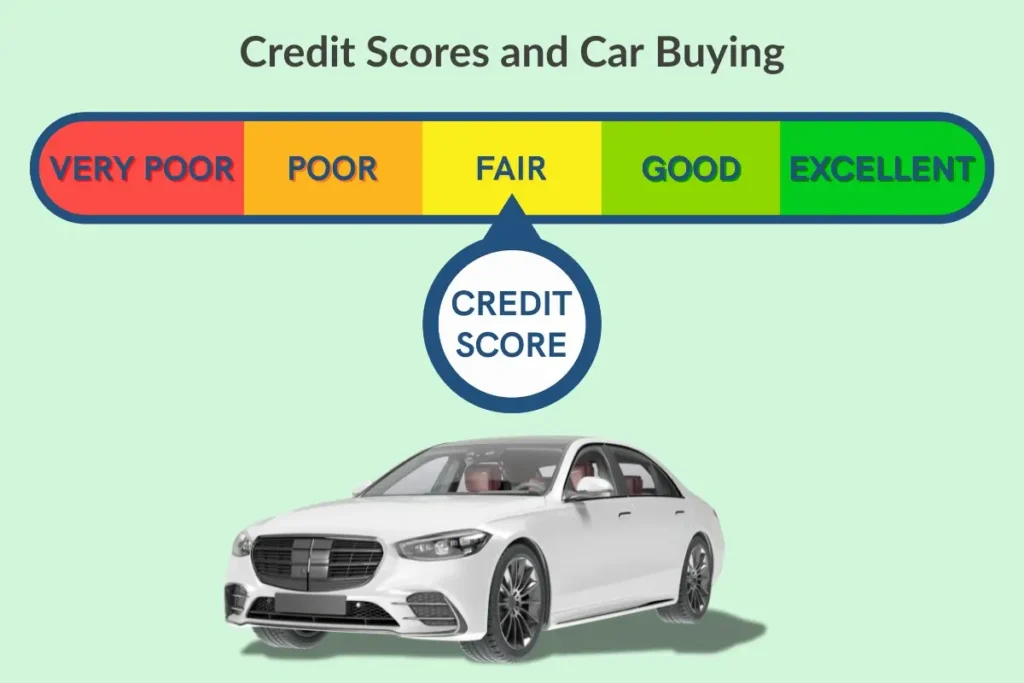

What Credit Score Is Needed to Buy a Car

Just as climbing Mount Everest requires different levels of preparation for various routes, securing a car loan demands different credit scores depending on your chosen path. You’ll find

What Credit Score Do First-Time Homebuyers Need to Buy a House?

If you’re one of the millions of Americans planning to buy your first home in 2025, you may be wondering what credit score a first-time home buyer needs

How Late Payments Impact Your Credit Report

Let’s consider Sarah, who missed her credit card payment by just 35 days while moving between apartments. Like many consumers, she didn’t realize this single oversight would slash